US | Big 4

Job Cuts Hit Recently Hired and Promotion-Eligible Staff as PwC Adjusts to New Realities

US | Customs

Donald Trump announces sweeping new tariffs on international movie imports, calling foreign incentives a threat to U.S. film industry jobs and national security.

EU | Customs

The European Commission extends tariff suspension on U.S. imports until April 14, 2025, aiming to resolve trade tensions and avoid escalation

Big 4

The overhaul will reduce the number of the firm’s “economic units” to 32

US | EU | Customs

European Parliament publishes key insights into EU-US trade relations and the EU's potential responses to a trade conflict

Italy | Indirect Tax

The investigation, led by the Milan Prosecutor’s Office, could impact e-commerce taxation and international trade relations

US | Tax Policy

Many of the eliminated positions are associated with tax compliance efforts

US | Customs

DSTs imposed by France, Austria, Italy, Spain, Turkey, the UK, and others will be assessed

US | Direct Tax

US Lawmakers Advocate for Expansion of IRS Direct File Program in Letter to Treasury and IRS Nominees

US | Tax Policy

As unduly restricting nations' ability to set independent tax policies

US | Customs

Agreement to Delay Tariffs for 1 month Amid Border Security Deal

US | Customs

President Trump issued Executive Orders imposing new tariffs on imports from Canada, Mexico, and China, effective February 4, 2025, ranging from 10% to 25%

US | Canada | Customs

Update on the latest U.S. tariff measures against Canada and the Canadian government’s response

US | Customs

Drafted tariffs and sanctions have been placed on hold

US | Tax Policy

We’re in the process of developing a plan to either terminate all of them or decide what’s next for those positions

US | Customs

As US and Chinese companies prepare for the potential impact of President Trump’s protectionist trade policies, uncertainty remains pervasive

EU | US | OECD BEPS

Highlighting the need for fair taxation and advancing climate initiatives at the Davos World Economic Forum

US | OECD BEPS

Any commitments made by the previous administration regarding the Global Tax Deal are declared void within the US

US | Customs

White House publishes memorandum that sets deadlines for various investigations and reports, to be delivered by April 2025

US | Tax Policy

US: IRS Commissioner Resigns on Trump´s Inauguration Date, Democrats Raise Concerns Over IRS Nominee

As IRS Commissioner Danny Werfel steps down, Trump´s Candidate Billy Long's Record on Controversial Tax Credit is being challenged

US | Customs

President´s Inauguration date, January 20, 2025 will be the birth day of the new agency

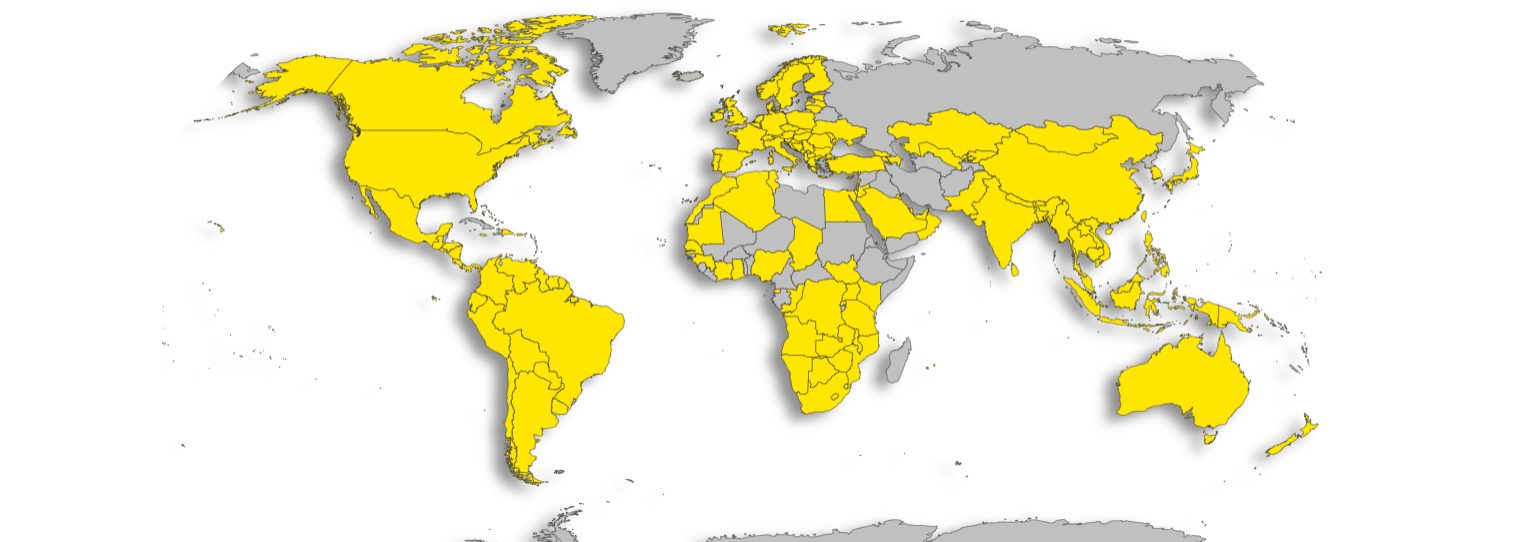

EU | US | Customs

With rising trade uncertainty between the US and its closest trade partners, we are analyzing key figures from the recent history of the EU-US trade relationship

US | Transfer Pricing

Notice 2025-4 Aligns with OECD Report on Amount B of Pillar 1, Launching For Comments

Canada | US Customs

Expected 25% tariff on all Canada- US imports, Canada is preparing a list of retaliatory tariffs targeting US goods

US | Customs

Strategic export controls to “address national security threats”

US | Customs

Talk of the Town on the Thanksgiving Holiday: Sweeping US Tariffs First Targeting Mexico, Canada, China, and BRICS nations

US | Tax Policy

Republicans are Set to Tackle Key Agenda Amid Federal Debt Concerns

US | Tax Policy | Trump 2.0

Donald Trump’s renewed economic agenda highlights a focus on tax cuts, deregulation, and strategies to bolster U.S. business interests.

USA | Tax Policy

William McKinley began with a strong stance on high tariffs but gradually recognized their costs. With Trump following a similar path, history offers a vital lesson.

US | Tax Policy

Details on adjustments and modifications to over 60 tax provisions that will affect taxpayers when they submit their returns in 2026.

OECD | Tax Policy

OECD Taxation Working Papers No 70 Released

US | Big4

Tax & Legal achieved the fastest growth benefiting from Changing Regulatory Landscape and Pillar 2

US | Transfer Pricing

Stricter Enforcement and Documentation Standards

US | Tax Policy

Democrats are drafting legislation in case Harris wins, Trump proclaims tariffs up to 200% for foreign automobiles

US | OECD BEPS

Firm opposition to the OECD’s global minimum tax deal, the future of U.S. involvement in the OECD’s tax framework remains uncertain

OECD BEPS

Latest BEPS Developments

USA | Direct Tax

Millions of taxpayers across the U.S. are reminded to make their third-quarter estimated tax payments by September 16, 2024. This deadline is crucial for individuals whose income is not subject to withholding, such as the self-employed, investors, and retirees. Late or missed payments could lead to significant penalties.

US | Customs

Tackling Unsafe De Minimis Shipments

USA | Direct Tax

This initiative marks a turning point in IRS enforcement, as it strengthens the agency's ability to recover unpaid taxes and boost compliance among the wealthiest.

US | Big4

New leadership continues restructuring at the US Firm

US | Tax Policy

Taxes at the Forefront of the US Presidential Elections with “Trump Sales Tax,” “Tax Cuts for Billionaires,” and “Tax Deductions” as buzzwords

US | Tax Policy

Trump and Harris in their own words at the US Presidential Debate

Canada | Digital Services Tax

Reaction to US request on DST

US Election

So far, deviating from the practice followed by other major party candidates

US | Tax Policy

Economic agendas of candidates for the next US President cannot be more different

US | Tax Policy

Unveiled during the Democratic National Convention in Chicago

UN | International Tax

A path to a universally accepted and effective international tax framework remains complex

USA | Tax Policy

President's 8.2% tax rate claim for billionaires sparks debate among experts and draws criticism from political opponents

OECD | Transfer Pricing

Essential for ensuring that developing countries can tax lithium exports appropriately

US | Tax Policy

Focus on Tax Increases in the State-Run by Democrats Candidate to US Vice President

Tax Technology | E-Invoicing and E-Reporting

Adding EDI and E-invoicing Capabilities

UN | Tax Policy

US Feedback on the Zero Draft Terms of Reference for a UN Framework Convention on International Tax Cooperation

US | Transfer Pricing

$16 billion of Potential Incremental Tax and Interest Liabilities

Big 4 | Tax Policy

Deloitte published 2024 Global Tax Policy Survey interviewing +1000 professionals from 28 countries with 90% being multinational organizations.

United Nations | Transfer Pricing

Shaping Global Tax Norms and Addressing Transfer Pricing Challenges

Big 4 | Tax Technology

Increased focus on AI adoption, Crypto asset accounting and tax compliance.

US | Mexico | Transfer Pricing

This is the second renewal of the agreement, preserving the core elements of the original framework

OECD | G20 | International Tax

Historic declaration on international tax cooperation

OECD G20

Key reports on international tax cooperation, digital economy challenges, and inequality highlight OECD's pivotal contributions to G20 financial policy discussions.

US | Personal Income Tax

Candidate for US President has a history of Transparency

United Nations | International Tax

Priorities include Taxation of the digitalized and globalized economy; income derived from cross-border services, high-net-worth individuals

US | Russia | International Tax

Mutual agreement on Suspension

US | Direct Tax

Courts will now employ traditional statutory construction tools to interpret laws.

US | Direct Tax

Guidance for complying with the new excise tax on stock repurchases

Canada | OECD

Relevant Revenues since January 1, 2022, are impacted

United States | Direct Tax

Congress has the authority to attribute an entity's realized and undistributed income to its shareholders and partners.

OECD BEPS

Pillar One and Pillar Two Tax Measures, CbCR Safe Harbour Guidance, Qualified Status

Tax Technology

Aims at Enhancing Tax Technology Solutions and Accelerating AI Innovation

Big4

Increasing early career compensation and development, Integrating AI in Tax and Audit Processes

US | Personal Income Tax

After the successful pilot, IRS plans to make Direct File a permanent option for federal tax returns, accessible for more taxpayers in the 2025 filing season

OECD Pillar 1

Pillar 1 encounters roadblocks

OECD BEPS

Advancing towards a final agreement on Pillar One, the anticipated signing of the Multilateral Convention by the end of June

OECD | Tax Crime

Supporting the Implementation of Principle 2 of the OECD Recommendation on Tax Crime

OECD | Personal Income Tax

Annual publication provides details of taxes paid on wages in OECD countries.

OECD BEPS

Tax Challenges Arising from the Digitalisation of the Economy.

Worldwide Indirect tax

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

US, Big 4

PricewaterhouseCoopers LLP (PwC) has been censured by the Public Company Accounting Oversight Board (PCAOB) and faces a civil money penalty of $2,750,000 due to violations related to maintaining independence.

OECD Amount B of Pillar One

A simplified approach to applying the arm's length principle to baseline marketing and distribution activities.

Brazil | France | Global Minimum Tax

Brazil and France at the forefront in bringing forward the idea of 2% tax

Canada | Budget 2024

“The government is asking the wealthiest Canadians to pay their fair share”.

US | Direct tax

Delivers Strong 2024 Tax Filing Season; Expands Services for Millions

Canada | Indirect Tax

Proposed Budget Changes in British Columbia (BC), Canada, contain retroactive amendments to BC PSTA with significant shift in software taxability

Reach your target audience

Contact us at hello@taxspoc.com