LATAM | Tax Policy

How Regional Cooperation and Exchange of Information (EOI) are Driving Revenue Growth and Fairer Tax Systems.

Big 4

The overhaul will reduce the number of the firm’s “economic units” to 32

OECD | Transfer Pricing

Jurisdictions can adopt OECD’s Latest Guidelines on the Amount B approach for relevant transactions starting from fiscal years commencing on or after January 1, 2025

US | Customs

Agreement to Delay Tariffs for 1 month Amid Border Security Deal

US | Customs

President Trump issued Executive Orders imposing new tariffs on imports from Canada, Mexico, and China, effective February 4, 2025, ranging from 10% to 25%

US | Customs

Drafted tariffs and sanctions have been placed on hold

Argentina | Tax Policy

Collections and Customs Control Agency (ARCA) will be established with less bureaucratic structure

OECD | Tax Policy

OECD Taxation Working Papers No 70 Released

Peru | Customs | Transfer Pricing

English Translation of Guidelines Available Here!

OECD BEPS

New Treaty Strengthens Pillar Two Global Minimum Tax with Subject to Tax Rule, Protecting Developing Countries' Tax Bases

Colombia | Tax Policy

Impact on Corporate and Capital Gains Rates

OECD BEPS

Latest BEPS Developments

Argentina Direct Tax OECD BEPS

Decree 749/2024 Aims at Attracting Investors

Brazil | Transfer Pricing

Multiple Tax developments in Brazil by the end of August:

Brazil | Indirect Tax

Draft VAT Law is available to download here!

Brazil | Transfer Pricing

English and Portuguese versions available!

UN | International Tax

A path to a universally accepted and effective international tax framework remains complex

Chile | Indirect Tax | Customs

Fine-tuning the bill with further amendments expected

OECD | Transfer Pricing

Essential for ensuring that developing countries can tax lithium exports appropriately

UN | Tax Policy

US Feedback on the Zero Draft Terms of Reference for a UN Framework Convention on International Tax Cooperation

US | Transfer Pricing

$16 billion of Potential Incremental Tax and Interest Liabilities

Big 4 | Tax Policy

Deloitte published 2024 Global Tax Policy Survey interviewing +1000 professionals from 28 countries with 90% being multinational organizations.

United Nations | Transfer Pricing

Shaping Global Tax Norms and Addressing Transfer Pricing Challenges

US | Mexico | Transfer Pricing

This is the second renewal of the agreement, preserving the core elements of the original framework

OECD | G20 | International Tax

Historic declaration on international tax cooperation

OECD G20

Key reports on international tax cooperation, digital economy challenges, and inequality highlight OECD's pivotal contributions to G20 financial policy discussions.

United Nations | International Tax

Priorities include Taxation of the digitalized and globalized economy; income derived from cross-border services, high-net-worth individuals

Brazil | Indirect Tax

Lower House Approved VAT reform capping VAT rate and adding more exemptions

Argentina | Tax Reform

Signature of Historic May Pact, symbolic declaration, centered around Tax.

Brazil | Transfer Pricing

Aligned with OECD Guidelines

OECD BEPS

Pillar One and Pillar Two Tax Measures, CbCR Safe Harbour Guidance, Qualified Status

OECD BEPS

Advancing towards a final agreement on Pillar One, the anticipated signing of the Multilateral Convention by the end of June

OECD | Tax Crime

Supporting the Implementation of Principle 2 of the OECD Recommendation on Tax Crime

OECD | Personal Income Tax

Annual publication provides details of taxes paid on wages in OECD countries.

Worldwide Indirect tax

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

OECD BEPS

Tax Challenges Arising from the Digitalisation of the Economy.

Brazil indirect tax

First version of Tax Reform Proposal by Brazil´s Finance Minister with expected VAT rate to average 26,5%

OECD Amount B of Pillar One

A simplified approach to applying the arm's length principle to baseline marketing and distribution activities.

Brazil | France | Global Minimum Tax

Brazil and France at the forefront in bringing forward the idea of 2% tax

Brazil | Indirect Tax

Legislators roll up their sleeves preparing for Brazil´s VAT implementation

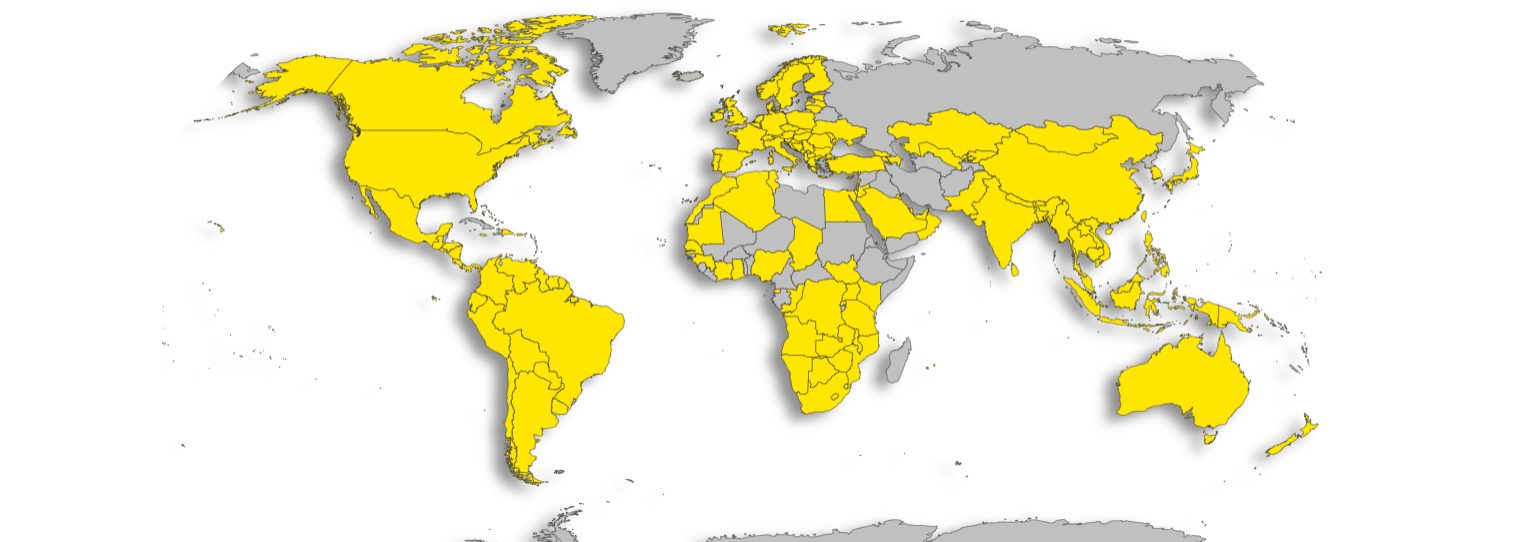

Reach your target audience

Contact us at hello@taxspoc.com