LATAM | Tax Policy

How Regional Cooperation and Exchange of Information (EOI) are Driving Revenue Growth and Fairer Tax Systems.

Egypt | VAT

Egyptian Tax Authority (ETA) Rolls Out a Transparent, Hassle-Free VAT System for Global Providers of Digital and Remote Services.

Italy | VAT

Italy Seeks Nearly €1 Billion in VAT payments from Meta, X, and LinkedIn, Targeting Transactions from 2015 to 2022

EU | Tax Policy

Focus on Green Transition, Addressing the VAT gap, and Commitment to Global Tax Reform are some of the priorities

Italy | Indirect Tax

The investigation, led by the Milan Prosecutor’s Office, could impact e-commerce taxation and international trade relations

US | Customs

DSTs imposed by France, Austria, Italy, Spain, Turkey, the UK, and others will be assessed

India | Tax Policy

New Income Tax Bill on the horizon, push for certainty and economic expansion, focus on manufacturing incentives and IFSC growth

Belgium | Indirect Tax

Important Changes to Belgian VAT Filing and Payment Rules

Egypt | Tax Policy

A Bold Move Towards a More Dynamic Business Landscape

Egypt | Tax Policy

A Pivotal Step Towards Enhancing Innovation and Economic Growth in the Digital Transformation Era

China | Indirect Tax

VAT Law is Available to Download in English Here!

Updated VAT Deduction and Grouping Rules Aim to Align with EU Standards and Reshape Business Strategies

China | VAT

Adopted end of December 2024, it aims aligning China´s VAT system closer to international standards

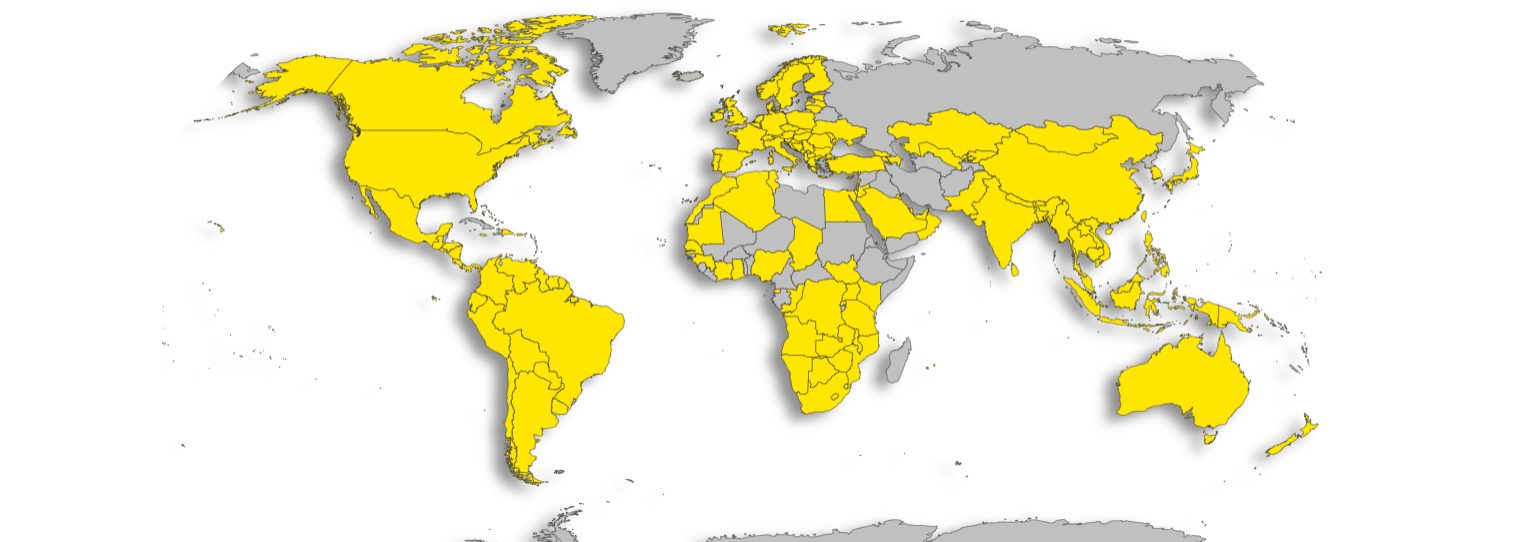

Global | VAT

From new tax rates to mandatory e-invoicing and digital economy rules

EU | Indirect Tax

Modernizing Tax Procedures, replacing paper VAT exemption certificates for Embassies, International Organizations, Armed Forces

OECD | Tax Policy

Recent OECD reports show average tax-to-GDP ratio among OECD countries largely stable in 2023, growing role of VAT revenues and ongoing reforms

Egypt | VAT

Non-Resident Vendors must adhere to currency-specific transfers to comply with the Egyptian Tax Regulations.

Egypt | VAT

Egypt enforces stricter VAT rules for non-resident digital service providers, requiring registration, validation, and compliance with local tax laws.

EU | VAT

CJEU ruling clarifies EU VAT treatment for EV charging value chains, simplifying compliance for CPOs and eMSPs

Australia | Direct Tax

Litigation resulted in favorable outcome for ATO in 53% of cases, Settlements involving income tax and transfer pricing secured ATO 69% of disputed amounts

EU | E-invoicing and E-Reporting

Real-Time Digital Reporting and E-Invoicing will become mandatory in the European Union

UK | Tax Policy

Alongside the many announced changes, key highlights include efforts to close the tax gap, investments in HMRC and technology, as well as plans for e-invoicing and transfer pricing

UAE | Indirect Tax

Set to take effect on November 15, 2024

Ireland | Tax Policy

Spending, Revealing Largest social protection package in Ireland´s history

OECD | Tax Policy

Tax Policy Reforms 2024: OECD and Selected Partner Economies

Lithuania | E-Invoicing and E-Reporting

Real time data comparison between E-Invoicing System and VAT returns requires continuous monitoring also by the Tax Payer

Slovakia | Tax Policy

Multiple Tax changes expected under the Government of Robert Fico

Germany E-Invoicing and E-Reporting

Significant Flexibility on the Requirement to Receive AP Invoices by January 2025

Saudi Arabia | Tax Policy

Concludes on December 31, 2024

EU | Indirect Tax

Applicable for EU and Most of Non-EU Businesses Refunds

UK | Indirect Tax

HMRC's expectations around VAT accounting

The Netherlands | Tax Policy

How the Dutch Cabinet’s 2025 Budget Affects Taxpayers

Colombia | Tax Policy

Impact on Corporate and Capital Gains Rates

US | Tax Policy

Trump and Harris in their own words at the US Presidential Debate

US | Tax Policy

Taxes at the Forefront of the US Presidential Elections with “Trump Sales Tax,” “Tax Cuts for Billionaires,” and “Tax Deductions” as buzzwords

Argentina Direct Tax OECD BEPS

Decree 749/2024 Aims at Attracting Investors

South Africa | Tax Policy

Available for Public Comment

Brazil | Indirect Tax

Draft VAT Law is available to download here!

Switzerland | Indirect Tax

Swiss VAT updates to streamline compliance and tax calculations, effective January 1, 2025, with key changes for businesses and platforms

US | Tax Policy

Economic agendas of candidates for the next US President cannot be more different

Finland | VAT

Ministry of Finance proposes VAT hikes, small business relief, and vehicle tax adjustments in comprehensive fiscal overhaul

Chile | Indirect Tax | Customs

Fine-tuning the bill with further amendments expected

Tax Technology | E-Invoicing and E-Reporting

Adding EDI and E-invoicing Capabilities

UK | HMRC

HMRC published annual report 2023 to 2024: protected £41.8 billion in tax by tackling avoidance, completed 320,000 compliance interventions

UK | Tax Policy

VAT on Private Schools, OECD Pillar 2 Implementation, Increasing HMRC staff and focusing on Tax Technology,…

Malaysia | E-Invoicing and E-Reporting | Indirect Tax | E-Invoicing and E-Reporting

Flexibility in Submitting Consolidated E-Invoices During Initial E-Invoice Implementation Phase

Finland | Indirect Tax

Key details and practical implications for various business scenarios under the new tax regime.

India | Union Budget 2024-2025

Union Budget 2024-25 on International Tax

India | Direct Tax | Indirect Tax | Customs | Personal Income Tax

FM presents 2024-25 Budget: GST expansion, customs review, Income Tax Act simplification, and investment boost measures proposed. Aims to enhance compliance and stimulate growth.

Poland | E-Invoicing and E-Reporting

Extension is official!

UK | General Election

A Review of Labour Party's Manifesto on Taxation

Brazil | Indirect Tax

Lower House Approved VAT reform capping VAT rate and adding more exemptions

Argentina | Tax Reform

Signature of Historic May Pact, symbolic declaration, centered around Tax.

Italy | Indirect Tax | Direct Tax

Changes Affect Penalties Regarding Income Tax, VAT, and Withholding Tax Returns

Saudi Arabia | VAT

Additional time to correct any discrepancies in their tax records without incurring penalties

United Kingdom | Tax Gap

Tax Gap Estimated at 39,8 billion GBP for one year

France | E-invoicing

Available to Download in English Here!

Bulgaria | SAFT-T

Expected Scope, Requirements, and SAF-T format documentation in English are available to download!

Germany | E-Invoicing

Our Article Includes an English translation of Guidelines Available to Download!

European Union | VAT

VAT Liability does not necessarily require actually receiving remuneration

European Union | VAT

The ECJ provides clarification on the concept of a VAT fixed establishment on June 13, 2024

UK | CIT | VAT | PIT

Promises to Lower taxes and calling to vote for Tories on July 4 Elections

Saudi Arabia Tax Amnesty

Initiative, originally set to end on December 31, 2023, will end June 30, 2024

France | E-invoicing

Technical specifications expected June 19, 2024, Go Live deadlines maintained

Spain | E-Invoicing

Rumor has it Spanish e-invoicing will be deferred to mid - 2026.

The Netherlands | Indirect Tax | Environmental Tax

Tax Plans concern mainly VAT, Fly Tax, Plastic Packaging Tax

Italy | Environmental Tax | Plastic Tax

Postponed again!

European Union | Indirect Tax

Non- EU business eligible to file VAT refund claim in a EU country should file their 2023 claims by 30 of June

European Union | ViDA

A look at Explanatory Memorandum to the Council Directive amending Directive 2006/112/EC as regards VAT rules for the digital age

European Union | ViDA

Digital Reporting Requirements, Platforms, Single VAT Registration

European Union | VAT | Withholding Taxes

ECOFIN Council Meeting of May 14, 2024 has 2 Tax related topics on Agenda

Poland E-invoicing

Detailed Analysis of the KSeF Audit: Unveiling Flaws and Planned Remediation Steps

Worldwide Indirect tax

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

Brazil indirect tax

First version of Tax Reform Proposal by Brazil´s Finance Minister with expected VAT rate to average 26,5%

Saudi Arabia Tax Incentive

Saudi Arabia unveiled a 30-year tax incentive for multinational companies interested in setting up their Regional Headquarters (RHQ) within the country on December 5, 2023. Subsequently, the Zakat, Tax and Customs Authority (ZATCA) released the RHQ Tax Rules on February 16, 2024, in response to this announcement.

Italy | UK | Indirect Tax

The agreement will have retrospective effect from 1 January 2021

Finland | Indirect Tax

The government is considering implementing the VAT rise before year end, with the Finance Minister reportedly looking for a quicker implementation

Singapore | E-invoicing | APAC

Implementation of InvoiceNow for GST-Registered Businesses and Free InvoiceNow Services for Newly Incorporated Businesses

Malaysia | E-invoicing

Failure to issue e-Invoice may result in penalties or imprisonment for each non-compliance

EU | Indirect Tax | E-Invoicing

Latest update from VAT Expert Group discussions

EMEA | Indirect Tax | VAT

The VAT Expert Group (VEG) recently convened in Brussels for a meeting.

India | CIT | PE | Permanent Establishment | APAC

Physical presence of employees in India is indeed a prerequisite for determining the existence of a Service PE

India | Indirect Tax

The imposition of GST on intragroup guarantees represents a significant regulatory shift

Saudi Arabia | VAT

A reminder of the key points regarding the VAT refund process for non-residents

Brazil | Indirect Tax

Legislators roll up their sleeves preparing for Brazil´s VAT implementation

Canada | Indirect Tax

Proposed Budget Changes in British Columbia (BC), Canada, contain retroactive amendments to BC PSTA with significant shift in software taxability

Poland | Direct Tax

The enactment of this act is anticipated to greatly improve tax administrations' access to data regarding taxpayers' income from sales made through digital platforms.

Italy | Plastic Tax

Expected postponement for the 7th time until July 1 2026. Impacted taxpayers will have new compliance obligations, including registration, quarterly tax returns filing, and payments

Germany | E-Invoicing

Parliament Approves Legislation Introducing E-Invoicing Mandate

Reach your target audience

Contact us at hello@taxspoc.com