Big 4

The overhaul will reduce the number of the firm’s “economic units” to 32

OECD | Transfer Pricing

Jurisdictions can adopt OECD’s Latest Guidelines on the Amount B approach for relevant transactions starting from fiscal years commencing on or after January 1, 2025

India | Tax Policy

New Income Tax Bill on the horizon, push for certainty and economic expansion, focus on manufacturing incentives and IFSC growth

US | Customs

President Trump issued Executive Orders imposing new tariffs on imports from Canada, Mexico, and China, effective February 4, 2025, ranging from 10% to 25%

US | Customs

As US and Chinese companies prepare for the potential impact of President Trump’s protectionist trade policies, uncertainty remains pervasive

China | Indirect Tax

VAT Law is Available to Download in English Here!

China | VAT

Adopted end of December 2024, it aims aligning China´s VAT system closer to international standards

US | Customs

Strategic export controls to “address national security threats”

China | Customs

Overview of the New Regulations on Export Control of Dual-Use Items

Australia | Big 4

Report on Ethics and Accountability in the Audit and Consultancy Sector contains numerous recommendations post PWC Australia scandal

Australia | Direct Tax

Litigation resulted in favorable outcome for ATO in 53% of cases, Settlements involving income tax and transfer pricing secured ATO 69% of disputed amounts

China | Tax Policy

China's Economic Stimulus Amid Rising Global Tensions

Australia | Transfer Pricing

Effective from 1 January 2025, most significant change to CbC reporting to-date

OECD | Tax Policy

OECD Taxation Working Papers No 70 Released

Australia | Tax Policy

New Pathway for Taxation Disputes

EU | China Customs

A levy of up to 39% in Response to EU´s Tariffs on Chinese Electric Vehicles

EU | Customs

Additional tariffs on Chinese-made EVs up to 35.3% for five years

OECD BEPS

New Treaty Strengthens Pillar Two Global Minimum Tax with Subject to Tax Rule, Protecting Developing Countries' Tax Bases

OECD BEPS

Latest BEPS Developments

China | Big4

The toughest ever penalty received by a Big Four accounting firm in China, accusations of aiding in the concealment of fraud, exodus of clientele and layoffs at the firm

Australia | Tax Policy

Focus on new high-risk tax areas for multinationals, Improvement of public reporting on large business tax information to boost transparency amongst other focus areas

UN | International Tax

A path to a universally accepted and effective international tax framework remains complex

OECD | Transfer Pricing

Essential for ensuring that developing countries can tax lithium exports appropriately

UN | Tax Policy

US Feedback on the Zero Draft Terms of Reference for a UN Framework Convention on International Tax Cooperation

Big 4 | Tax Policy

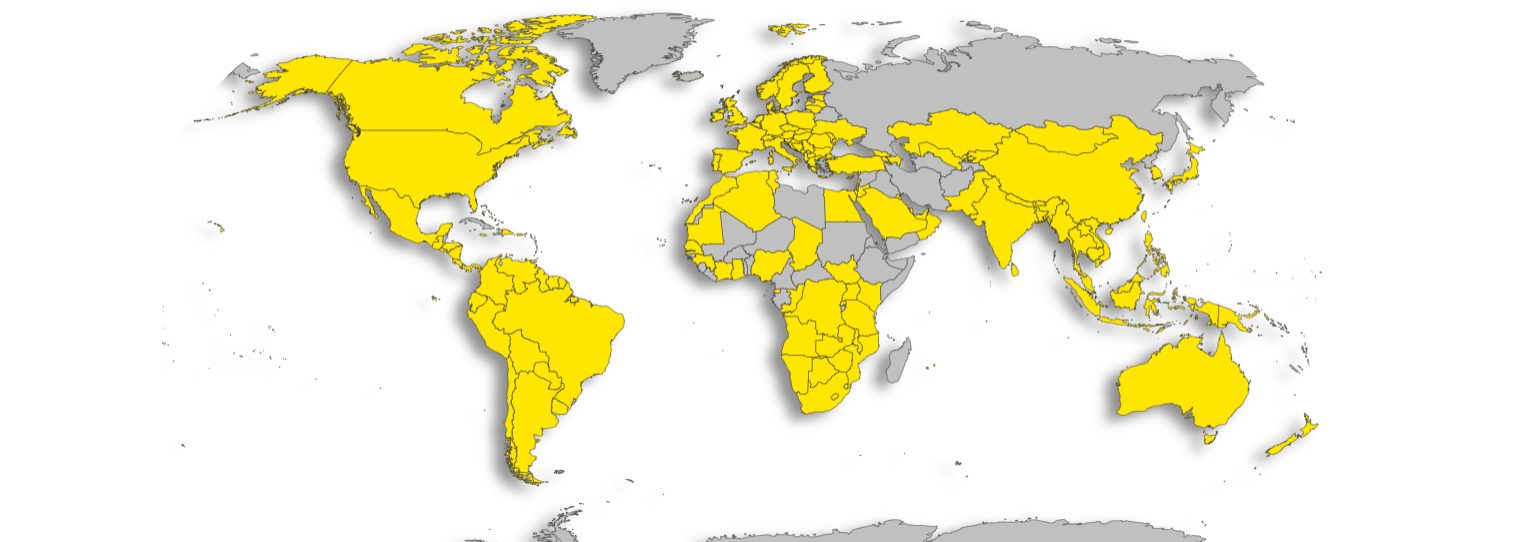

Deloitte published 2024 Global Tax Policy Survey interviewing +1000 professionals from 28 countries with 90% being multinational organizations.

United Nations | Transfer Pricing

Shaping Global Tax Norms and Addressing Transfer Pricing Challenges

Malaysia | E-Invoicing and E-Reporting | Indirect Tax | E-Invoicing and E-Reporting

Flexibility in Submitting Consolidated E-Invoices During Initial E-Invoice Implementation Phase

OECD | G20 | International Tax

Historic declaration on international tax cooperation

OECD G20

Key reports on international tax cooperation, digital economy challenges, and inequality highlight OECD's pivotal contributions to G20 financial policy discussions.

India | Union Budget 2024-2025

Union Budget 2024-25 on International Tax

Big4 | Scandal

Leaving Clients, Staff reductions, Pay cuts, Fines

India | Direct Tax | Indirect Tax | Customs | Personal Income Tax

FM presents 2024-25 Budget: GST expansion, customs review, Income Tax Act simplification, and investment boost measures proposed. Aims to enhance compliance and stimulate growth.

United Nations | International Tax

Priorities include Taxation of the digitalized and globalized economy; income derived from cross-border services, high-net-worth individuals

Australia | Tax Policy

Aims to Restore Public Trust in Tax Profession

Australia | Direct Tax | Transfer Pricing

Full Federal Court Reverses Federal Court Decision on Embedded Royalty.

OECD BEPS

Pillar One and Pillar Two Tax Measures, CbCR Safe Harbour Guidance, Qualified Status

European Union | China | Customs

Investigation Reveals Unfair Subsidies in China. Provisional Duties to be introduced on July 4, 2024

Australia | CIT

If approved, public CbC reporting will be effective for reporting periods starting on or after 1 July 2024

OECD Pillar 1

Pillar 1 encounters roadblocks

OECD BEPS

Advancing towards a final agreement on Pillar One, the anticipated signing of the Multilateral Convention by the end of June

OECD | Tax Crime

Supporting the Implementation of Principle 2 of the OECD Recommendation on Tax Crime

European Union | New Zealand | Customs

Most goods will have tariffs removed upon the FTA's commencement

OECD | Personal Income Tax

Annual publication provides details of taxes paid on wages in OECD countries.

OECD BEPS

Tax Challenges Arising from the Digitalisation of the Economy.

Worldwide Indirect tax

Annual update. Worldwide VAT, GST and Sales Tax Guide 2024

Australia | Big 4

Job Cuts, Penalties

OECD Amount B of Pillar One

A simplified approach to applying the arm's length principle to baseline marketing and distribution activities.

Brazil | France | Global Minimum Tax

Brazil and France at the forefront in bringing forward the idea of 2% tax

Philippines | Direct Tax

Details on Return filing and payments

Australia | Direct Tax

Aiming at greater transparency and accountability in corporate tax matters

Singapore | New Zealand | E-Invoicing

Further steps in promoting eInvoicing adoption in the Asia-Pacific (APAC) region.

UAE | Direct Tax

The purpose of Guide CTGQGR1 is to offer comprehensive guidance on Qualifying Group Relief as per Article 26 of the UAE Corporate Tax Law.

India | Transfer Pricing

A structured and proactive approach to transfer pricing certainty

Singapore | E-invoicing | APAC

Implementation of InvoiceNow for GST-Registered Businesses and Free InvoiceNow Services for Newly Incorporated Businesses

Malaysia | E-invoicing

Failure to issue e-Invoice may result in penalties or imprisonment for each non-compliance

India | CIT | PE | Permanent Establishment | APAC

Physical presence of employees in India is indeed a prerequisite for determining the existence of a Service PE

India | APAC | Direct Tax

No further profit attribution if an associated enterprise is remunerated at arm´s length

India | Indirect Tax

The imposition of GST on intragroup guarantees represents a significant regulatory shift

Australia | Thin Capitalization

Making Multinationals Pay Their Fair Share—Integrity and Transparency Bill 2023 passed in Senate and House of Representatives

Reach your target audience

Contact us at hello@taxspoc.com